Silei Huo

Data-driven problem solver with extensive experience in Banking and Technology (Payments), focusing on Strategic Planning, Product Management, and Data Analytics. MBA from London Business School.

Data Science | FinTech | Payment Processing | Banking

View My LinkedIn Profile

Bank Stock Price Forecasting & Time Series Analysis

Part I - EDA

Time series analysis of megabank stock, including BAC, JPM, HSBC, RY… in the past 20 years, from 2003 till 2023.

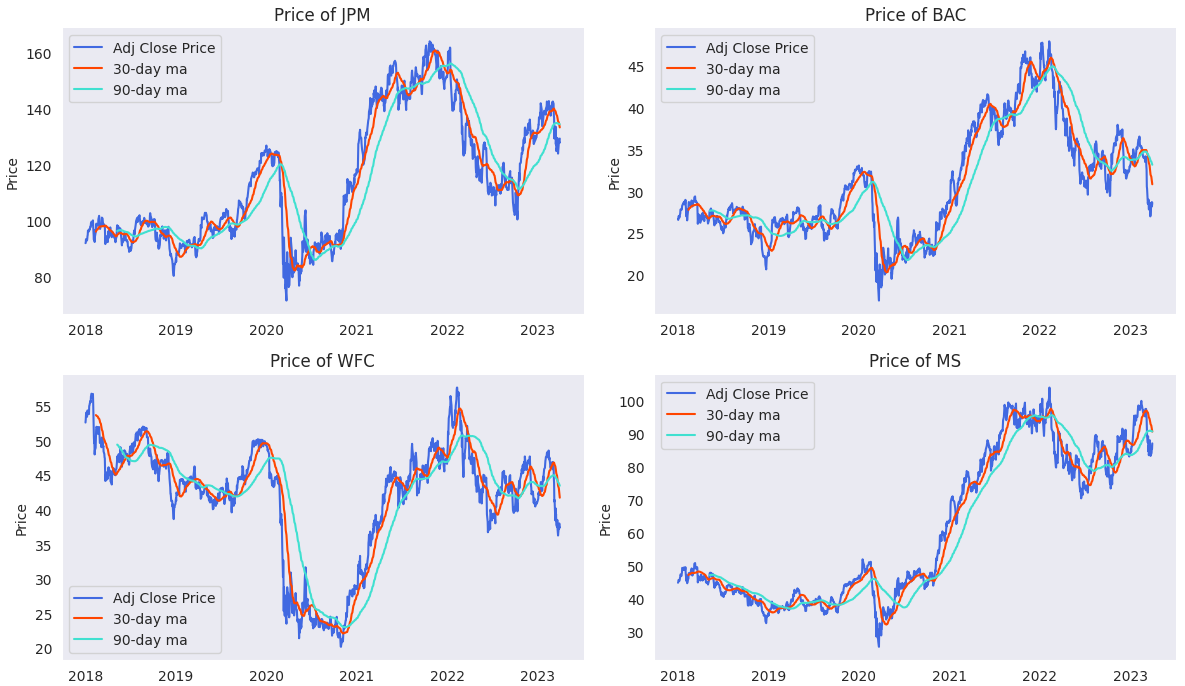

Price change over the past 5 years

Bank stock price was significantly impacted during 2020 COVID and the rising of interest rates since 2022.

2023 Q1 daily return

It shows 2023 March banking crisis including the collapse of SVB significantly impacted the price drop for major banks.

Comparison of yearly return among megabanks

For the past 20 years, JPM generates a relative higher and more stable yoy return, outperforming other mega banks. While RBC & PD, as well as MS and GS indicates similar return and risk patterns.

Part II - Random Walk & ARIMA Model Forecasting

Forecasting long-term JPM stock price based on the historical price (2003-2021).

Applied log transformation and first-order differencing to stationarize the price data, to stationarize the data before modeling

Applied Random Walk with drift as forecasting model, with MAPE of 15.53%

Forecasting (converting to original price)

Though Random Walk and ARIMA generates similar MAPE score (~15%), the residuals are still not normally distributed and homoscedastic. Additional transformation and differencing will be needed to further stationarize the data. However, model capture the overall trend in the long term.

Also, the significant impact during 2008 financial crisis and 2020 COVID which causes large variance in the dataset should be considered and adjusted.

Further improvement TBC…

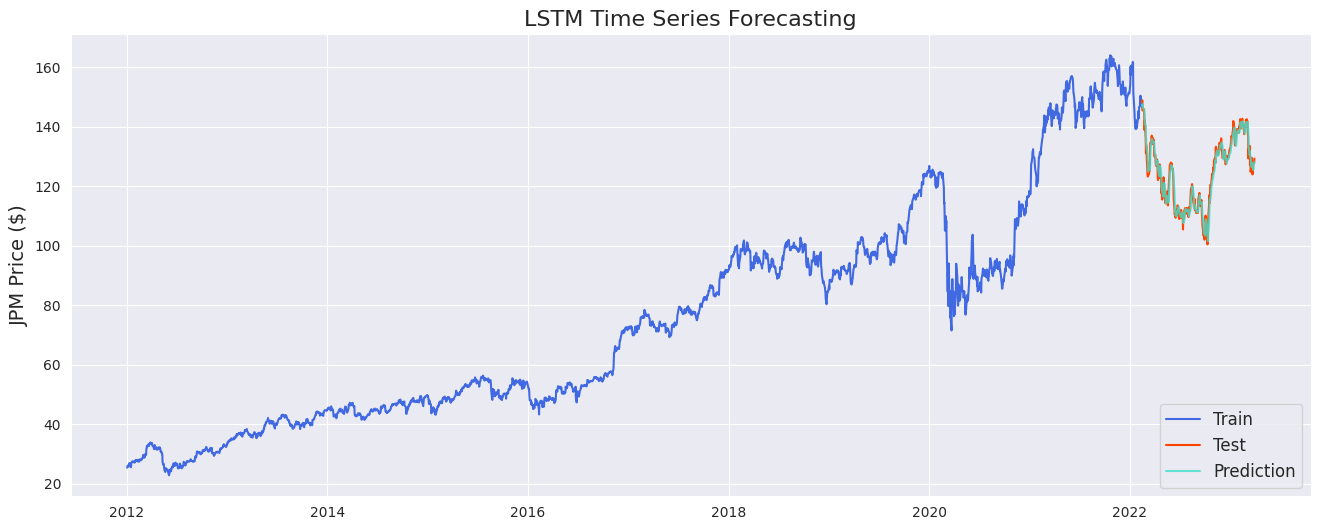

Part III - LSTM for Time Series Forecasting

Forecasting short-term JPM stock price based on the past 60-day close price.